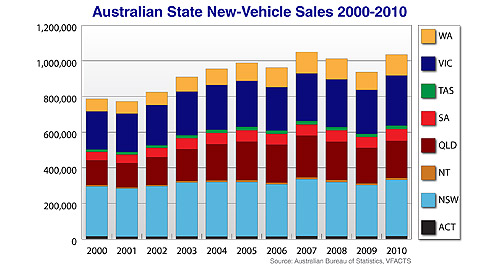

News - Market Insight - Market Insight 2011Market Insight: Shadow over sunshine stateHeavy hitter: Queensland is one of the most significant markets for commercial vehicles in Australia. Queensland’s car market problems hit new heights with the natural disasters7 Feb 2011 By TERRY MARTIN LAST week’s new-vehicle sales figures from the Federal Chamber of Automotive Industries reflected the severe impact floods had on Queensland last month and served as a reminder of the sunshine state’s importance to the industry, and the nation’s economic health in general. In January alone, sales in the state fell 12.8 per cent (or 1953 vehicles) compared with January 2010 – a month when the car market was showing strong recovery from the economic downturn and in which Queensland was ahead of the industry average with a rise of 12.8 per cent – a striking contrast to this year’s beginning. Significantly, that trend did not continue in Queensland throughout the course of last year, despite the industry’s return to more than a million sales, which coupled with this year’s flood disaster and now Cyclone Yasi could see further pressure building on the state. Although some in the industry are anticipating a short-term spike in vehicle sales from insurance claims, it remains to be seen whether Queensland experiences a long-term fall in consumer and business confidence (among other indicators) as a result of the natural disasters. That could see the state’s share of the new-vehicle market fall below 20 per cent for the first time since 2003. Australia clearly needs Queensland to recover, not just from the latest setbacks but also on a broader level. While the state also experienced damaging floods in early 2010, in July last year the Motor Trades Association of Queensland was appealing directly to the state government over a range of factors affecting motorists – higher registration fees and rising compulsory third party premiums, to name just two – and warning of a “worrying trend in the automotive market and its consequences for the entire automotive value chain, which contributes solidly to Queensland’s economy”. The association said its concerns were vindicated by both new and used-car sales figures, which showed that Queensland was going against the national trends. With new vehicles, MTA Qld said that, in stark contrast to the record monthly highs the industry as a whole experienced in May and June last year, Queensland’s corresponding results were record lows – or at least the lowest since 2004. In terms of used cars, average monthly sales in the state were at their lowest level since 2002 – 4.1 per cent down on 2009 in the first half of last year and 8.8 per cent down on the 2007 pre-GFC level.  From top: Nissan Navara, Mitsubishi Triton, Volkswagen's upcoming Amarok. From top: Nissan Navara, Mitsubishi Triton, Volkswagen's upcoming Amarok.Queensland finished 2010 with 207,919 new vehicle registrations, up just 4.3 per cent compared to the industry’s 10.5 per cent rise and well down on every other state and territory – the ACT was next with an 8.0 per cent rise, while Victoria (14.1 per cent), WA (17.1 per cent) and the NT (12.9 per cent) all exceeded the industry average. So, as costs are rising for Queensland motorists, the substantial growth the state has enjoyed over the past decade and more – which has followed economic growth in the state – now looks to be tapering off. Queensland’s high point came in 2007 when the Australian new-vehicle market passed the million-unit mark for the first time. It recorded 234,551 sales for a 22.3 per cent share, further cementing its position as the third-strongest state behind NSW (320,055 for a 30.5 per cent share) and Victoria (265,961, or 25.3 per cent). Amid the GFC, Queensland’s share fell to 21.2 per cent in 2008 (214,872) and held steady on 21.3 per cent the following year as sales dipped below 200,000 for the first time since 2003. Last year, its share of the market fell to 20.1 per cent – its lowest for more than seven years. Considering this, we should highlight just how far Queensland had come over the years. Having accounted for 18 per cent of the market in 1995 (116,000 units out of 650,000), sales grew in line with the national average up to the early 2000s – by then Queensland’s new registrations were up to around 138,000 – and from 2002 the growth chart continued steadily, climbing to 19.6 per cent in 2003 and reaching 21.9 per cent in 2005 and 2006 with annual sales well past 210,000. Queensland is widely considered an important market for luxury vehicle sales, as car company executives have attested in recent years when opening new dealerships in Brisbane and along the state’s golden coastline. Data from the Motor Vehicle Census published by the Australian Bureau of Statistics last year – relating to vehicles registered at 31 March 2010 – shows that Queensland is, perhaps above all else, a crucial market for light commercial vehicles. Accounting for 15.3 per cent of all vehicles (new and old alike) registered in Australia – the second-highest proportion behind passenger cars – LCV registrations have increased across the nation, but nowhere greater than in Queensland, which has experienced 30.4 per cent growth over the five-year period from March 2005. While Queensland is a solid third behind Victoria and NSW in terms of total vehicle registrations, it has the second-highest number of LCVs registered in Australia (26.0 per cent). NSW is only just ahead on 26.7 per cent while Victoria is perhaps surprisingly well back on 22.2 per cent. Other ABS data shows how Queensland is faring in terms of sales of new passenger cars, SUVs and ‘other’ (read: commercial) vehicles. Last year, Queensland sold 109,171 passenger cars, 48,183 SUVs and 50,547 ‘other’ vehicles, while Victoria sold 170,983 cars, 61,856 SUVs and only 48,590 ‘others’ – the latter reflecting Queensland’s current dominance over Victoria, and most of the rest of Australia, in terms of commercials. In comparison, NSW sold 185,987 cars, 72,282 SUVs and 58,213 ‘other’/commercial vehicles last year. Significantly, in Queensland’s golden year of 2007, the state was Australia’s biggest-selling market for LCVs, registering 60,667 new vehicles in the ‘other’ category – miles ahead of Victoria (45,933) and almost 4000 units clear of NSW (56,987). Queensland was also high in SUV terms, with less than 3000 units separating it and Victoria (45,457 to 48,335). Also of note is that vehicle registrations in Queensland have risen 21.4 per cent over the past five years, which is well above the national average of 15.4 per cent. The state’s average annual increase of 3.9 per cent from 2005-10 was well above the national average of 2.9 per cent and, among the big-selling states, second only to Western Australia (4.1 per cent), which has escalated in line with the mining boom. Many other figures in the available data underline the fact that Queensland, which has long been a top-three state in Australia, has become an increasingly important market – growing sales and share over the past decade, closing the gap to Victoria, providing huge benefits to the northern state and, in general, to the state of the nation’s automotive market. But it is clearly under pressure. The issues run deeper than floods, and deeper than Cyclone Yasi. However, these disasters should heighten awareness of the need for the state to bounce back, for everyone’s sake.  Read more |

Click to shareMarket Insight articlesResearch Market Insight Motor industry news |

Facebook Twitter Instagram