Market insight: Performance end of market booms

BY BARRY PARK | 25th Jun 2013

Luxury car-makers including Mercedes-Benz, BMW, Audi and Lexus are seeing sales of sports-honed models surging, and even Australian go-fast car brand HSV is keeping the new-found pace.

The strong demand for performance-honed vehicles is also reflected at the top end of the market, with sales of premium vehicles such as the Mercedes-Benz S-Class limousine, Jaguar XJ saloon and even the Porsche Panamera grand tourer leaping ahead of last year.

Sales in the segment so far this year are up by more than 40 per cent on last year, VFACTS data shows.

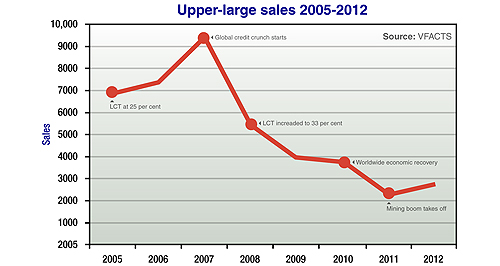

The segment has been in slow decline ever since the introduction of the luxury car tax, an extra impost that can, in the case of high-end Bentleys and Rolls-Royce models, add hundreds of thousands of dollars to the pricetag of a car.

German luxury brand Mercedes-Benz has tipped that its performance-honed AMG models are set to hit 2000 sales next year, which means they could account for as many as one in 20 Benz-badged models rolling out of Australian showrooms.

According to Mercedes-Benz Australia/Pacific senior manager of corporate communications David McCarthy, AMG sales are “doing very well” although he couldn’t put a finger on exactly why buyers are increasingly interested in performance-honed models.

“Obviously people are attracted by the performance and equipment levels of the car, and I think, too, that people are seeing the AMG models as a reward for work well done,” he said.

“We’re seeing that the proportion of AMG sales have increased across the board, and it’s now about five to six per cent of our total volume.

“Last year, the Australian and New Zealand markets had the highest penetration rate of AMG models. It seems Australia and New Zealand have a real soft-spot for rear-drive performance cars.”And the front-drive cars. Mercedes-Benz is already sitting on 100 pre-orders of its A-Class-based A45 AMG, with the upcoming CLA45 AMG coupe also attracting a big bank of pre-orders.

According to Mr McCarthy, it is the smaller AMG models that will build the most growth for the Benz-badged performance range.

According to Audi Australia’s general manager of corporate communications Anna Burgdorf, much of the growth in its S- and RS-badged model range is down to availability of the cars.

“The good news for us is that we do have a lot of cars entering that end of the market,” she said.

“A lot of it is also to do with the availability of the cars. It allows people to test the performance cars in the range, and also to make an emotional decision to buy them.”Likewise, Lexus has seen a big jump in sales of its F-Sport line that ups the cosmetic – and in some cases performance – of its mainly V6-engined model range.

Sales of F-Sport-badged IS models is sitting at about three in 10 sales of its IS small sedan range.

“It’s just because of the sporty nature of the market,” Lexus Australia public relations manager Tyson Bowen said.

“I also think that it doesn’t necessarily mean buyers need to have a big V8 in front of the driver.”Mr Bowen said Lexus was looking to add more performance-honed models to its vehicle line-up after identifying a number of holes in the range.

“In two years we’ve gone from zero F-Sport models to having 11 F-Sport models in our line-up,” he said.

Lexus has also noticed a big bump with its V8-engined IS F, although Mr Bowen said sales were limited by the lack of availability of the car.

Over at BMW, Australian sales of its M-badged range make it the second-highest market for the performance cars per head of population worldwide.

“Year to date, the sale of our M range is regularly making up close to two per cent of sales,” BMW Australia product communications manager Scott Croaker said.

“When you look across any brand at the moment they all have a high proportion of performance car sales. I think it just reflects the Australian culture.”As a sign of how well the M badge can draw in buyers, Mr Croaker said BMW had sold just two of its range-topping 550i model since the car’s launch, yet more than 30 M5s had rumbled out the showroom door.

The performance-focused trend is not at the higher end of the market, either.

Holden’s vehicle tuning offshoot, HSV, has sold about 3000 cars a year on average, and expects its new Gen-F series to continue to roll out of showrooms despite the car it is based on – the Holden Commodore large car – struggling to maintain sales.

Commodore sales last month were almost 35 per cent lower than for May last year, in part because Holden misread the market and produced the wrong mix of large-car models ahead of the launch of the heavily upgraded VF series.

“The large-car market (in Australia) has been in decline for some time,” HSV director of marketing Damon Paull said.

“I think we can be confident in saying that the performance car market that we compete in has bucked that trend.

“If you look at that large-car subset, say between $70,000 to $100,0000, I think our share (at HSV) approaches somewhere around 20 per cent (of the market).

“I think that sort of suggests that, yes, we’ve bucked the large-car trend, and it’s still a strong, sustainable demand,” he said.