EV sales on slow-burn

BY IAN PORTER | 23rd Nov 2012

The upgrade comes just days after Nissan CEO Carlos Ghosn abandoned the company’s EV sales predictions for the United States and pulled the plug on a grand opening ceremony for a new lithium-ion battery plant in Smyrna, Tennessee, which was built using part of a $US1.4 billion ($A1.35b) loan from the US Department of Energy.

It also follows hard on the heels of General Motors’ announcement of the all-electric Leaf-rivalling Chevrolet Spark due for release next year – a model that will “play a vital role” but which the company has elected not to give a definitive sales target at this stage.

This is not unexpected considering GM had to pull back its US sales expectations for the range-extender Volt – which officially went on sale as a Holden in Australia this month – and with the backdrop of slow global EV take-up for the Leaf, Mitsubishi’s i-MiEV and other electric cars now in the marketplace.

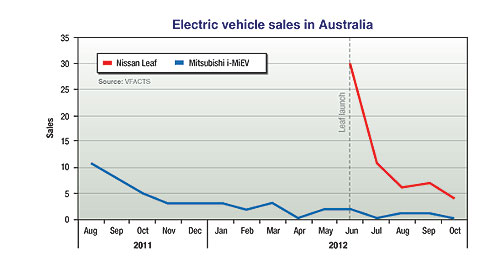

Sales of EVs in Australia have also stalled, despite the highly publicised release of the Leaf in June.

Nissan had expected to double Leaf sales in the US this year, but is instead now struggling to match last year’s sales.

The Japanese car-maker sold 9679 Leafs in 2011 and Mr Ghosn had promised to double that in 2012, but US sales reached only 6791 in the 10 months to October 31.

Mr Ghosn has consequently been forced to backtrack on his expectations, telling Bloomberg Television in Mexico City: “The forecast we have given ourselves this year will not be reached.”The difficult EV sales environment provides a sombre backdrop to the 2012 Australian Electric Vehicle Conference to be held in Melbourne on December 4.

The conference, organised by Future Climate Australia, will explore the state of the EV market and government policy development.

The keynote address will be delivered by Kristian Handberg, the manager of the Victorian Department of Transport’s four-year EV trial that ends in mid-2014.

But the undercurrent at the conference will be the unexpectedly slow adoption of EVs, both here and overseas.

While Nissan’s Leaf has been billed as the world’s first mass-produced EV, the car was launched here five months ago from $51,500 as a toe-in-the-water exercise, with an Australian sales target of 300 for the first year.

However, local registration figures show Leaf sales have dropped from a high of 30 at launch in June to just four last month.

At Mitsubishi, sales of the tiny i-MiEV also slowed to a trickle soon after launch in August last year.

Only 44 i-MiEVs have been registered since the car officially went on sale in Australia, including just six in the past seven months.

A total of 82 EVs have been sold in Australia so far this year, with VFACTS figures showing 14 i-MiEV and 68 Leaf registrations, with the majority being commercial sales (51 compared with 31 to private customers).

Not including pre-launch registrations, total i-MiEV and Leaf sales in Australia since their introduction amount to 112 units.

Despite this paucity of sales, Mitsubishi Australia’s key account manager for i-MiEV, Mark Whyte, told GoAuto he was not overly concerned.

“It was always more about a branding exercise than big sales,” he said. “It was always about getting the market ready for what is coming down the track.”Mitsubishi has not retreated from its original EV program, which aims eventually to have some form of electric drive – full battery, hybrid, plug-in hybrid or range-extender hybrid – available in every model.

Mr Whyte said the market’s apparent hesitancy about EVs was related to the fact that, in these early stages, buying an EV is simply more complicated than buying a vehicle with an internal combustion engine (ICE).

“It’s different to buying a Lancer,” he said. “The price of the car ($48,800) changes the economics and, for many companies, makes it a multi-department decision.”He said fleet managers are not thrilled because they could buy two or three other cars for the same outlay, but government departments and marketing people want them for the promotional value.

“I got a ‘yes’ from one government in June this year and they are still going through the motions to get everything ready.

“They have to organise recharging infrastructure, tending for an energy supplier and other stuff. There are just complications in big organisations you don’t get with a standard car.”Then there are issues for private buyers who live in apartment blocks.

“They have to go through the body corporate and, of course, no-one wants to pay for someone else’s electricity, so there has to be a separate meter and the building manager has to become involved.”Mr Whyte said that EV design options were opening up as battery technology continued to improve, with “energy density going through the roof”.

“That means a buyer, if they choose electric, will be able to choose a 100km battery, a 200km battery or a 300km battery, according to how much they want to spend.

“You may even be able to drive around town with a 100km battery in your car and rent a 500km battery for your holiday trip. That avoids carting around an expensive and heavy large battery when you’re in town.”This year’s Australian EV conference will draw together a wide range of interested parties, including technology innovators, suppliers, government and manufacturers.

Event organiser Henry O’Clery, the executive director of Future Climate Australia, said he remains confident the future of the automotive industry in Australia lies, in part, with electrification.

“Australia is in a fortunate position now because we actually have all the elements of an indigenous electric vehicle industry,” said Mr O’Clery.

“We need to work out how to leverage this for the future wellbeing of the car industry.

“It would be a disaster of we allow this leadership position to slip through our fingers as the innovators take their talent and technology to overseas markets.”