Denso considers microprocessor spin-off

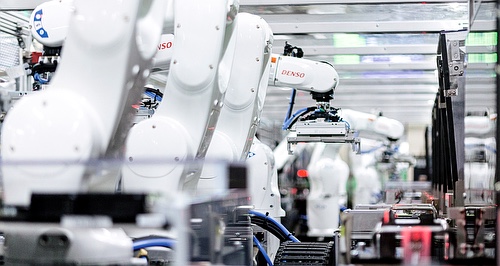

DENSO, one of the world’s largest automotive microprocessor manufacturers – and a key supplier to Toyota – might separate its chip business from the group’s main entity.

According to a report by Bloomberg, Denso chief technology officer Yoshifumi Kato said the company was examining a business case for the separation of its microprocessor- production division to see if it would be “better positioned outside of the company”.

“We need to think about whether the time will come when we sell semiconductors, alone, externally,” said Kato-san. “It's worth looking into whether that kind of structure is possible.”

Denso is the world’s second-largest automotive parts manufacturer and ranks as the world’s fifth largest supplier of automotive semiconductors – the firm’s microprocessor division generates about ¥420b ($A4.4b) in sales, Bloomberg reports. The chips Denso makes go into automotive parts it produces on behalf of car makers and other suppliers.

Kato-san told the publication that Denso, which had invested ¥160b ($A1.7b) in its semiconductor business during the past three years, was not considering utilising a potential spin-off of its chip business to raise fresh funds for other investments.

According to Kato-san, demand for automotive semiconductors will continue to escalate as the industry shifts to autonomous, electric and internet-connected cars.

At a briefing earlier this month, the Aichi-based firm said it was targeting ¥500b ($A5.3b) in sales from its in-house power and analog chip business – an increase of about ¥80b.

Nothing has been decided regarding a split yet, Kato-san said. Denso remains focused on meeting existing microprocessor demand for its customers and, as such, any split of the business will be deferred until such time as recent shortages have been addressed.

The microprocessor shortage has plagued automotive manufacturers since COVID-19-induced lockdowns saw a spike in consumer electronics at the end of 2020. This led to the supply of semiconductors being diverted from car companies resulting in production delays that were, in turn, exacerbated by global supply chain and logistical issues.

As reported by GoAuto last week, some chip supplies appear to be returning to normal. Concerns for global automotive production now centre on rising energy, fuel and material costs against a backdrop of accelerating inflation and higher interest rates.

Bloomberg reports that capacity is slowly returning to many of the world’s automotive production lines as the global semiconductor shortage finally shows signs of easing.

The breakthrough comes earlier than expected. BMW, Volkswagen and other companies recently suggested that it may be another two years before production lines returned to capacity while others, including Citroen and Toyota, said the reduction in microprocessor supply had forced them to revise their production forecasts downward.

Bloomberg reports that in some cases, microprocessor supply has affected global passenger vehicle output so severely that production numbers are yet to return to pre-pandemic levels and that many manufacturers are still struggling to source sufficient components to meet the production requirements of increasingly computerised cars.