Thailand looms as number one vehicle source

BY RON HAMMERTON | 1st Nov 2010

Japanese-based motor companies such as Toyota, Mazda and Suzuki are accelerating their switch from Japanese factories to large-scale Thai production to cut landed costs of vehicles and take advantage of the free-trade agreement between Australia and Thailand in the face of increasingly hot competition from new sources such as China and India.

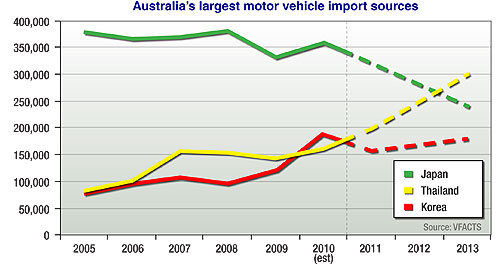

This is set to slash the volumes of Japanese imports into Australia from the current rate of about 360,000 vehicles a year to as few as 240,000 in two years.

At the same time, Thai-sourced vehicles could soar from the current 160,000 units a year to about 300,000 if mass sellers such as the Toyota Corolla and Mazda3 make the jump from Japanese factories to the Land of Smiles.

This would also outstrip the other big Asian source of motor vehicles for Australia, South Korea, which is likely to grow more steadily from the current level of about 170,000 units a year.

In Australia, Japanese imports have been largely steady for the past decade, peaking most recently at 378,992 in 2008 before slipping to 334,655 as a result of the global financial crisis last year. This year, they are on track for about 358,000, according to VFACTS data.

By comparison, Thai imports have doubled in just six years, from 84,841 to an estimated 162,000 vehicles this year at the current sales rate.

This growth in imports from the ‘Detroit of Asia’ has been driven mainly by the Japanese companies that have built mirror-image factories in Thailand, transplanting not just the production equipment but also their quality systems and work ethic.

Unlike some other Asian countries that make difficult demands such as local partnerships, the Thai government has opened the door wide to investment while at the same time taking a protectionist stance to foster the fledgling industry.

Thailand is also favoured for its relatively stable, democratic system – apart from a few coups and street protests – and reliable artisan culture that lends itself to high-quality production, way ahead of anything else in south-east Asia.

The Thai industry cut its export teeth on one-tonne utes, becoming the world epicenter of these rugged, top-selling vehicles.

Today, most of Australia’s one-tonners, including the top-selling Toyota HiLux, Holden Colorado, Mazda BT-50, Ford Ranger, Isuzu D-Max and Mitsubishi Triton, roll in from Thailand. Exceptions include Nissan’s European-built D40 Navara and – soon – the Argentinian-made Volkswagen Amarok.

Honda was the pioneer in Thai passenger car imports, taking a deep breath before switching Accord production for Australia from the United States to Thailand in the 1990s. To the surprise of many – including those within Honda – the quality of those Accords was perfectly acceptable, rating somewhere between American and Japanese standards.

Since then, Honda has moved all of its mass-sellers, including Civic sedan, CR-V, Jazz and City, into Thai factories for Australian showrooms – a move that most other Japanese companies are now attempting to emulate.

Mazda and partner Ford have just switched production of their Mazda2 and Fiesta siblings to Thailand, Nissan is about to join them with Micra and Suzuki is eyeing Thailand for its Swift and Splash.

Ford Australia is preparing to source its Focus small car from the kingdom – a move that could also precipitate a shift by Mazda of its hot-selling small car, the Mazda3, to Thailand.

Toyota has announced it is putting Prius into one of its Thai plants, although not for Australia at this stage.

The Prius move by Toyota could be a foretaste of things to come, with the world’s number one car-maker considering wholesale changes to its sourcing to escape the costs of Japanese production, including the relatively expensive Yen, to counter low-cost vehicles from Korea, China and India.

The success of HiLux in Australia – no-one complains about ‘Thai quality’ with the best-selling light truck in this neck of the woods – makes Thailand the hot favourite for the next-generation Corolla and Yaris.

As well, Toyota is considering a still-secret sub-compact car that could give it a cheap and cheerful competitor below Yaris. Again, Thailand looks the logical location.

Tallying the current volumes for all the existing models that GoAuto believes are either confirmed for Thailand – such as the Micra and Focus – with those that a likely to make the jump from Japan to Thailand – such as the Corolla, Yaris, Mazda3 and Suzuki Swift – arrives at a figure of about 135,000 units a year. This figure also includes full-year volumes of the Thai-built Mazda2 and Fiesta, which have only just started streaming into the country.

Added with the current volume of about 160,000 units a year from Thailand, we arrive at a potential export volume to Australia from Thai factories of about 295,000.

With the exception of the Ford models, most of these vehicles currently come from Japan. So, unless that country suddenly finds new products to join their more prestigious models on the boat to Australia, exports are going to drop dramatically.

At best guesstimate, the sales graphs of Thai and Japanese-built cars could cross in 2012 if the mass-selling Corolla and Mazda3 make the jump.

Thai production might also get a fillip from new light trucks that are in the pipeline, notably Ford’s Australian-designed and engineered Ranger and its Mazda BT-50 relation, and Holden’s next-generation Colorado and its first cousin, the Isuzu D-Max.

South Korea’s position as the third big Asian player for Australian imports has been given a large boost recently with the success of new-generation Hyundais such as the i30, as well as Holden’s GM-DAT-sourced Cruze and Captiva, both of which have made waves on the Australian market, largely at the expense of Japanese-made rivals.

This year, South Korean vehicles should come in at about 170,000 vehicles – a rise of about 40 per cent on last year’s 122,953 vehicles.

However, Holden will switch Cruze production to Australia early next year – putting a 30,000-unit hole in the annual Korean export tally.

Some of that deficit might be made up by added volumes from Holden’s new Barina Spark baby car and increased numbers from the next-generation Aveo-based Barina.

As well, Hyundai and partner Kia show no signs of wilting in their sales growth, so if the Korean giant ever gets around to building a HiLux rival, Korean exports volumes could be assured for years to come.

Of course, the elephants in the room are China and India. Although numbers from those countries so far are tiny, it seems only a matter of time before even the relatively new big-game hunters in the car game, such as Thailand, will themselves come under pressure.